All the results are ranked by the highest returns and the biggest gains in market capitalization.

Economatica discovered over 400 stocks which traded, on average, over $100 million dollars per day in 2017. We then ranked this impressive group of stocks by the highest returns to identify the Top 10 Winners in this category.

Topping our returns table is Restoration Hardware, which rewarded shareholders with a return of 180.81% in 2017. Square, Inc. took second place, producing a 154.37% return. Arista Networks, Inc. placed third in our Top 10, generating a 143.44% return last year. The manufacturing sector, when considered broadly, dominated our Top 10 Winners for the year with 7 high performing stocks, and two software publishers made the list, too.

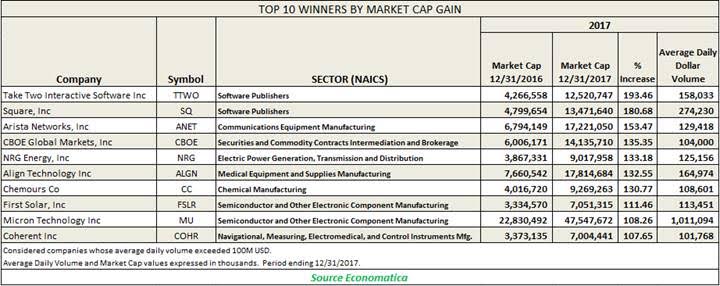

We also used the Economatica system also to identify the Top 10 Winners by market cap among this group of 400 highly traded stocks, those stocks whose average daily volume exceeded $100 million dollars.

Once again, the manufacturing sector dominates our Top 10 with 6 stocks but the two companies with the biggest gain are both software publishers.

Taking the top spot is Take Two Interactive Software, Inc., which saw an increase of 193.46% in market cap last year. Square, Inc. increased its market cap significantly as well, increasing 180.68%. Arista Networks, Inc. took third place again in this category, whose market cap grew 153.46% in 2017.

The stocks which had the biggest gain in market cap appear on the table below.

As important as high returns and growth in market cap are for the purposes of recognizing 2017’s top performers is noticing which stocks appear on both Top 10 Winners lists. 7 stocks managed to perform well in both categories. These include both software publishers, 4 manufacturers, and an electric power generation company. The 7 stocks which had the highest returns and the biggest gain in market cap are Square, Inc., Take Two Interactive Software, Inc., Arista Networks, Inc., First Solar, Inc., Chemours Co., Coherent, Inc., and NRG Energy, Inc.

You can use the Economatica system to generate your own observations. Ask us for a free trial.

In this edition of Value Reports we examined the IPO market in the 1st half...

In this edition of Value Reports, we explore the Top 25 foreign stocks ranked by...

Using the Economatica system we calculated the EV/EBITDA (TTM) multiple for key sectors in the...