In this challenging interest rate environment we explore the performance of REITs relative to the S&P 500. To illustrate the industry’s performance in this environment Economatica chose the Top 25 REITs ranked by Total Assets and examined several key metrics.

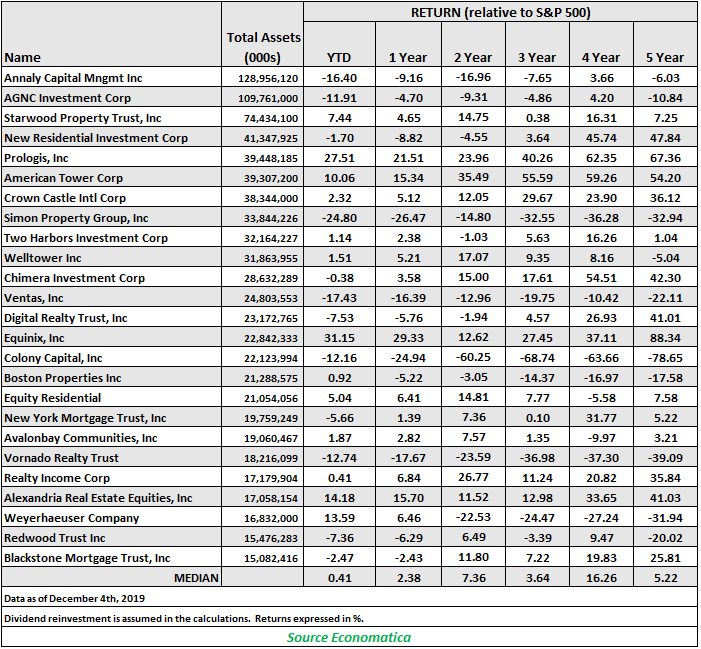

As can be observed from the 5-year table below the median returns for this group relative to the S&P 500 have ranged from 0.41% in the YTD return to 16.26% in the 4-year return.

On an individual basis there are a handful of companies which have performed well despite the pressures of interest rates and other factors. The companies with the highest YTD returns relative to the S&P 500 are Equinix (31.15%), Prologis (27.51%), and Alexandria RE Equities (14.48%).

The three largest REITs by total assets Annaly Capital Management, AGNC Investment Corp, and Starwood Property Trust, posted YTD returns of -16.40%, -11.91%, and 7.44% respectively.

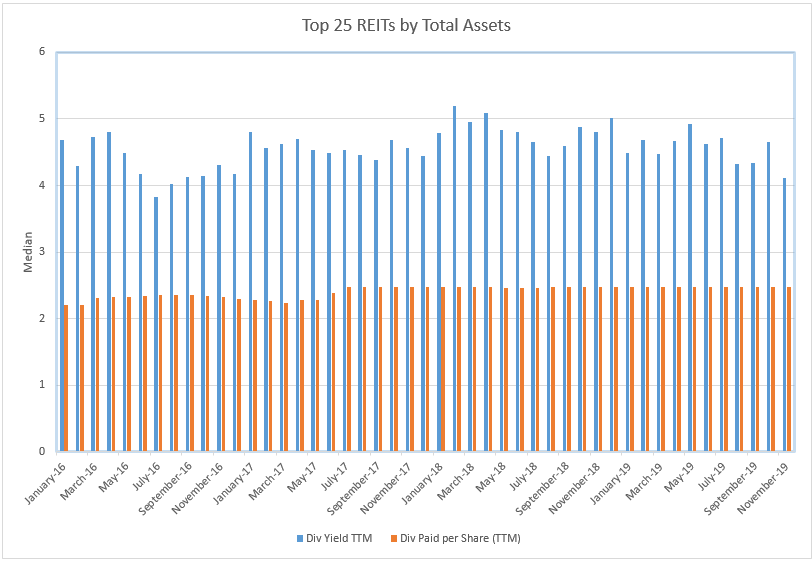

Dividend Yield and Dividend Paid per Share have remained stable and consistent throughout this period.

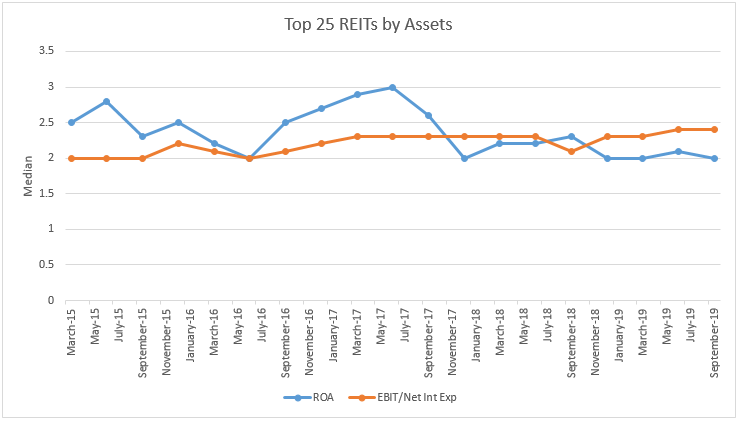

The indicators Return on Assets (ROA) and EBIT/Net Interest Expense, two key evaluation metrics for REITs, have also remained relatively stable in 2018 and 2019.

Economatica is an online investment research platform designed to facilitate deep fundamental and quantitative analysis. Asset managers, analysts, and other investment professionals have used Economatica for more than 30 years to research securities, identify opportunities, and make better investment decisions. To learn more please contact us.

In this edition of Value Reports we examined the IPO market in the 1st half...

In this edition of Value Reports, we explore the Top 25 foreign stocks ranked by...

Using the Economatica system we calculated the EV/EBITDA (TTM) multiple for key sectors in the...