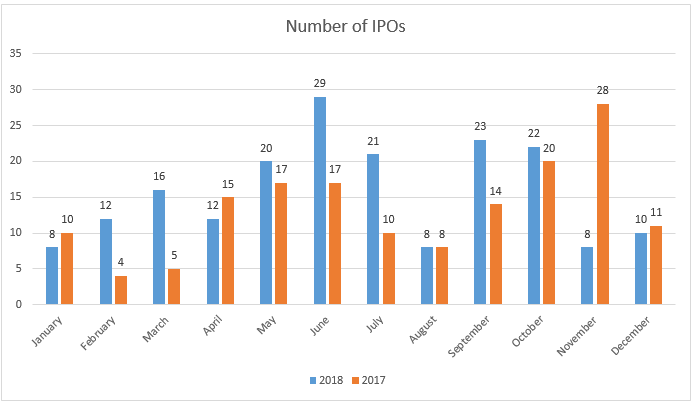

Using the Economatica system to filter through our comprehensive stock database we discovered there were 189 IPOs in 2018. This is a move up from 2017 when 159 IPOs were launched in the major exchanges. The IPO market is certainly robust and picking up steam.

Here are a few general observations about this group before diving into the details of the top and bottom performing new stocks for 2018:

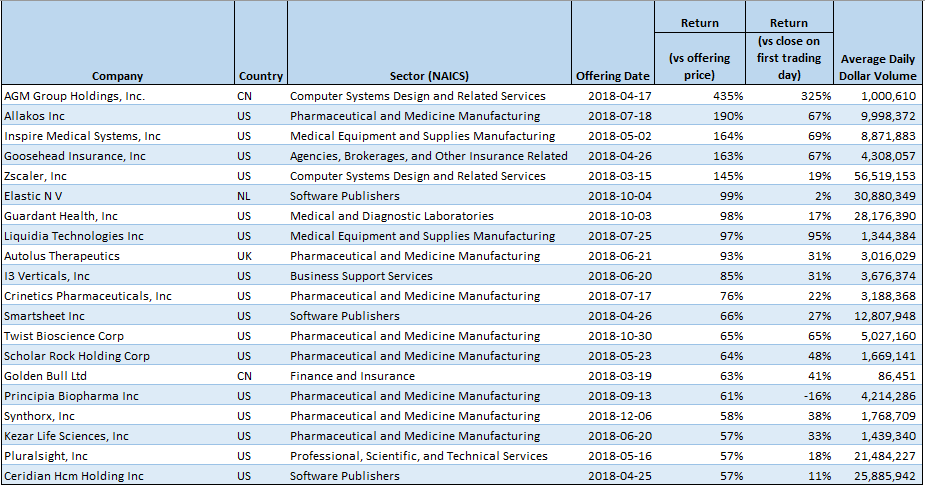

Among the best performing stocks launched in 2018 five posted over a 100% return (versus the offering price). These are AGM Group Holdings, Allakos, Inspire Medical Systems, Goosehead Insurance and Zscaler. The best performing stock on its opening day was AGM Group Holdings which returned 435% following its offering on April 17th.

Sixteen of the top 20 IPOs in 2018 when ranked by returns are from the US, while 2 are from China, one from the Netherlands, and one from the UK.

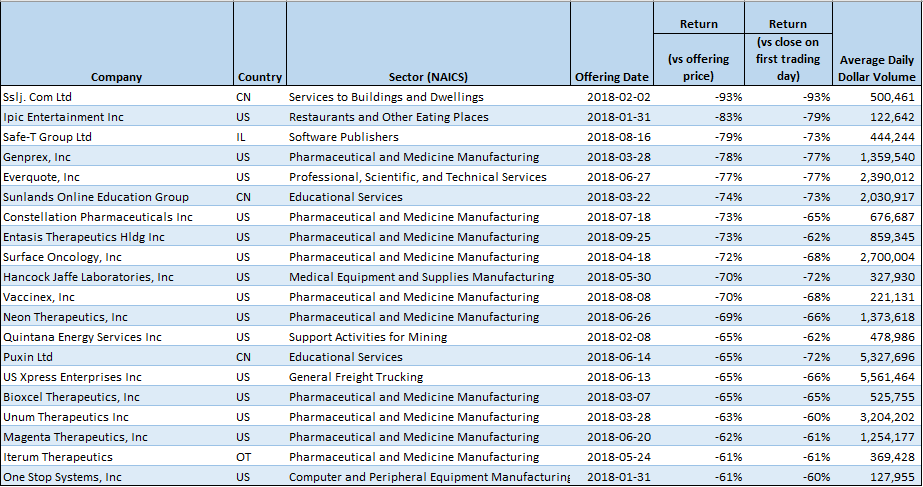

Looking at the worst performing companies the five companies which disappointed investors the most are Sslj.com, Ipic Entertainment, Safe-T Group, Genprex, and Everquote. Sslj.com had the most negative opening day of the year, with a of negative 93%.

Fifteen companies are from the US and five are foreign listings, including three from China. The majority of companies (11) in this group are in the Pharmaceutical and Medicine Manufacturing industry.

The highest number of IPOs was in the month of June, with 29 new stocks making their debut. In 2017, the highest number of IPOs was in the month of November, with 28 new listings. For the year 2018, the months of May, June, July, September, and October each had 20 or more companies going public while the least busy months with 8 were January, August, and November. Please see the table below for details.

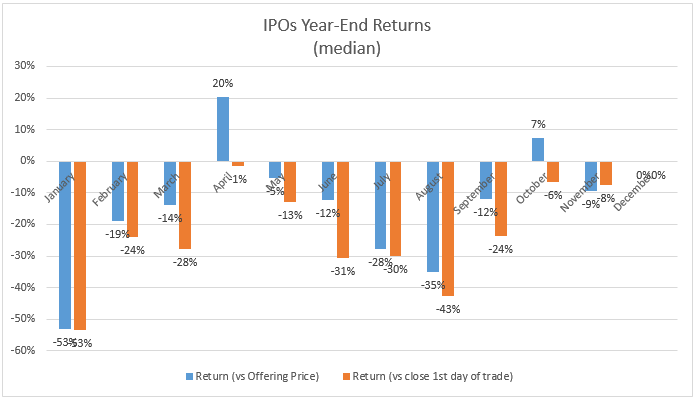

The chart below depicts the median return through the end of the year compared to offering price and closing price on first trading day.

The 12 IPOs listed in April 2018 was the best performing group, with a median return of 20% (versus opening price). On the flip side, the 8 IPOs listed in January 2018 was the worst performing group with a median return of negative 53%. In all, when looking at median returns, it is clear 2018 was a difficult year for IPOs.

The Economatica system offers a range of sophisticated analytic tools and financial data on an easy to use online research platform that empowers asset managers, analysts, and other investment professionals who conduct fundamental and quantitative analysis. Ask us for a free 14-day trial today and learn how to make your own observations.

In this edition of Value Reports we examined the IPO market in the 1st half...

In this edition of Value Reports, we explore the Top 25 foreign stocks ranked by...

Using the Economatica system we calculated the EV/EBITDA (TTM) multiple for key sectors in the...