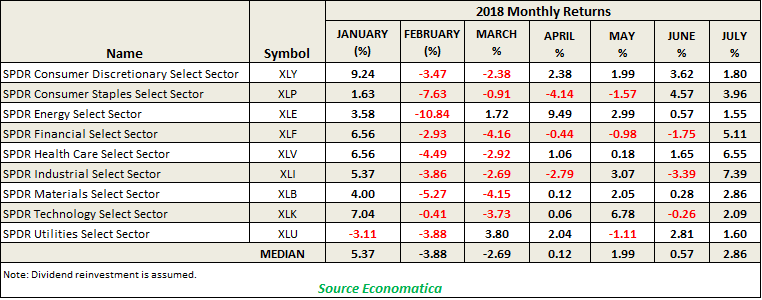

We found that the month of July was the first month in which all of the sectors in the sample performed positively. The highest return in July belongs to the SPDR Industrial Select Sector ETF, which returned 7.39%. The second highest was posted by the SPDR Health Care Select Sector ETF, which returned 6.55%, and the third highest spot was grabbed by SPDR Financial Select Sector ETF with 5.11%.

On the flip side of this, February marks the only month in which all the sectors posted negative returns. The worst performer was the SPDR Energy Select Sector ETF, which posted -10.84% for the month of February, followed by SPDR Consumer Staples Select Sector ETF with a -7.63%, and SPDR Materials Select Sector ETF which returned -5.27%.

Overall, the best performing month for the group was January, with the median return being 5.37%. Only the SPDR Utilities Select Sector ETF posted a negative returned in the month of January. Following January, July comes in second with a median return of 2.86% for the group. The worst performing month overall for the group was February, which returned a median -3.88%.

The Economatica system empowers asset managers, analysts, and other investment professionals who conduct fundamental and quantitative analysis with a range of sophisticated analytic tools and financial data available on an easy to use online research platform. Ask us for a free 14-day trial today and let us show you how.

In this edition of Value Reports we examined the IPO market in the 1st half...

In this edition of Value Reports, we explore the Top 25 foreign stocks ranked by...

Using the Economatica system we calculated the EV/EBITDA (TTM) multiple for key sectors in the...