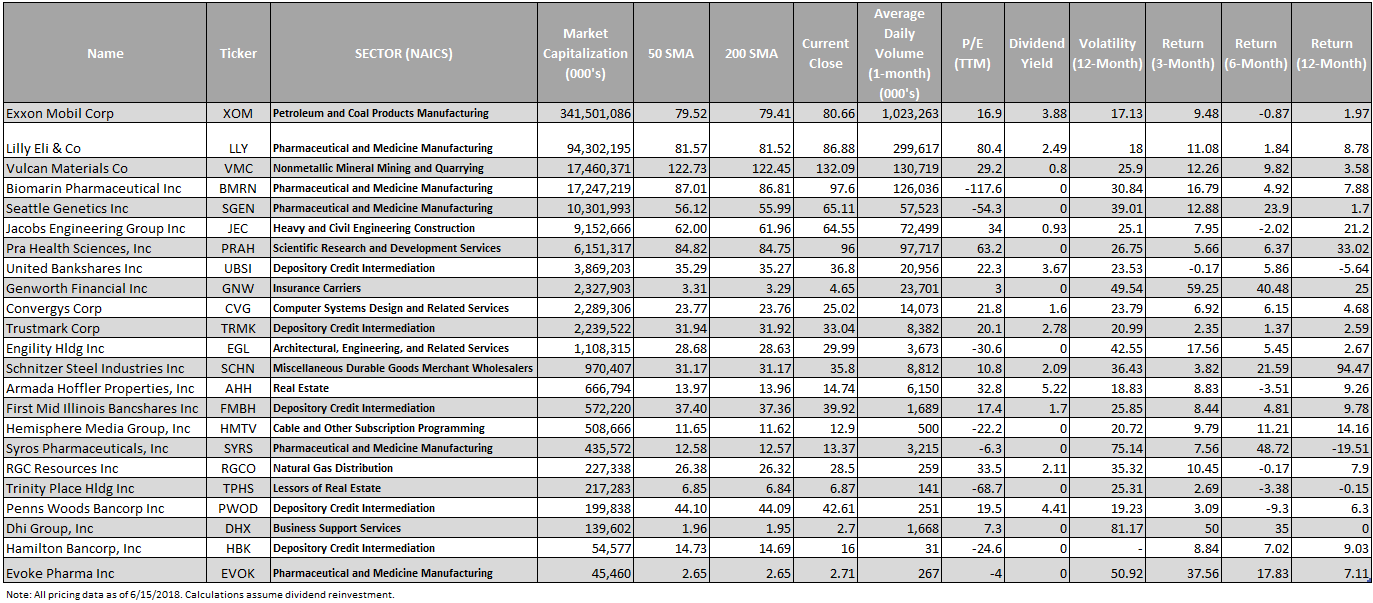

Economatica has powerful technical analysis tools. We used the Economatica system to highlight all stocks whose 50-day SMA crossed over their 200-day SMA. There were 23 stocks meeting this criteria, out of a universe of 3,600 stocks screened.

As a general rule, traders consider a bullish sign when the 50-day moving average crosses above the 200-day moving average. This is commonly known as Golden Cross and it’s a very popular technical indicator.

The oil giant Exxon Mobil Corporation is the largest company by market capitalization making our list. With a market capitalization of 341 billion USD, its 50-day SMA of 79.52 just crossed over its 200 SMA of 79.41.

The Pharmaceutical and Medicine Manufacturing sector had the highest number of companies making the cut, with 5 out of the 23 stocks that met the screening criteria being part of this sector.

Economatica is an online investment research platform designed to facilitate deep fundamental and quantitative analysis. Asset managers, analysts, and other investment professionals have used Economatica for more than 30 years to research securities, identify opportunities, and make better investment decisions. To learn more please contact us.

In this edition of Value Reports we examined the IPO market in the 1st half...

In this edition of Value Reports, we explore the Top 25 foreign stocks ranked by...

Using the Economatica system we calculated the EV/EBITDA (TTM) multiple for key sectors in the...