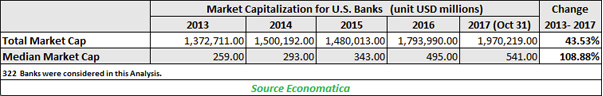

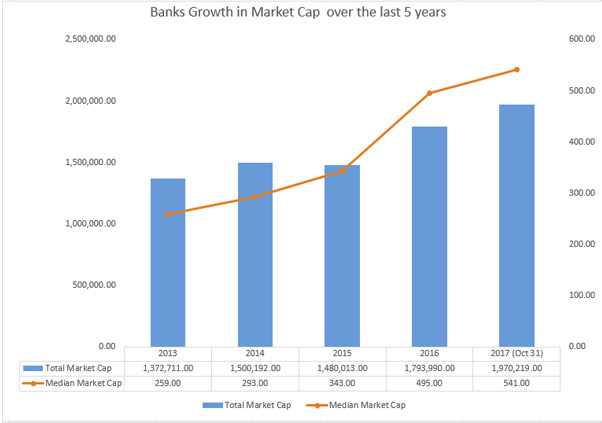

In this Value Report Economatica tracks the evolution of 322 banks since 12/31/2013 and confirms the impressive growth that the industry has experienced in recent years.

The aggregate market capitalization of the bank sector has grown 43.53% from 2013 to October 31, 2017. More interestingly perhaps to observe is the median market capitalization of this sector has grown nearly 109% in the same period and it’s increased every year since 2013.

To put this growth in market capitalization into perspective let’s take a look at the top 3 banks ranked according to today’s value. Unsurprisingly these are JP Morgan Chase, Bank of America and Wells Fargo. The stock prices of each of these companies has appreciated by 91%, 84% and 38% respectively since January 1, 2014 (up to October 31).

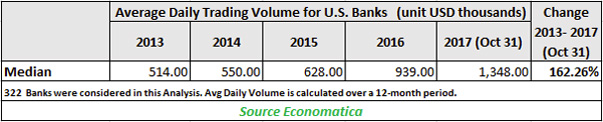

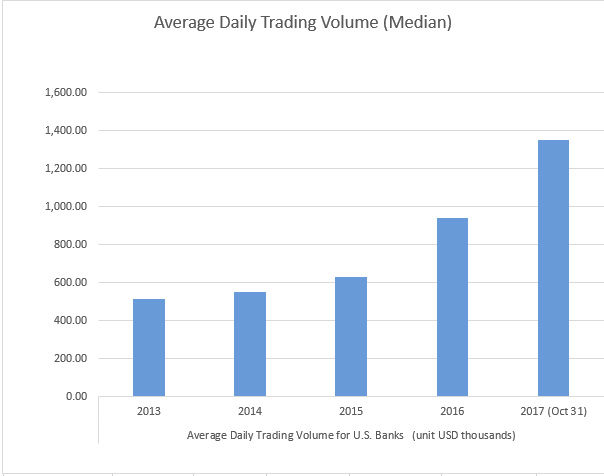

Similarly, the average daily trading volume has picked up at a similar pace for the period examined in this report. This observation clearly demonstrates that investors have taken notice.

The average daily trading volume on an annualized basis increased an impressive 162.26%, from 514 in 2013 to 1,348 through October 31, 2017. By looking at the bar chart below you can also determine that the most significant increases in annual trading volume occurred in 2015, 2016 and in this year, too.

Notes: 322 banks listed in the major exchanges (NYSE, NASDAQ and AMEX) were used for this analysis. Banks listed in US exchanges after 12/31/2013 were not considered in the sample.

Notes: 322 banks listed in the major exchanges (NYSE, NASDAQ and AMEX) were used for this analysis.Banks listed in US exchanges after 12/31/2013 were not considered in the sample. Banks were identified using NAICS code 5221.

In this edition of Value Reports we examined the IPO market in the 1st half...

In this edition of Value Reports, we explore the Top 25 foreign stocks ranked by...

Using the Economatica system we calculated the EV/EBITDA (TTM) multiple for key sectors in the...