Economatica has a powerful yet easy to use module for identifying, analyzing, and backtesting pair trades (long/short). There are two modes of operation:

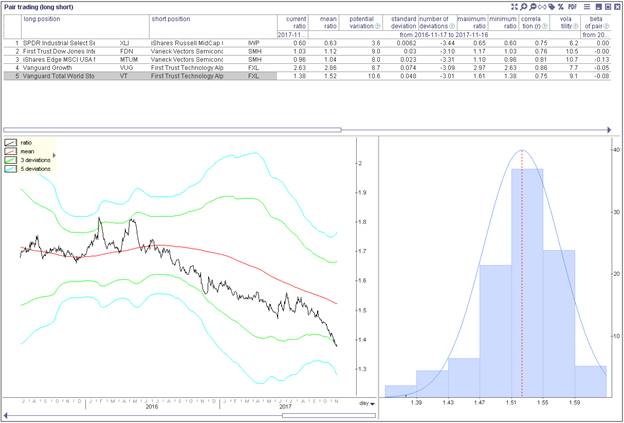

Simply enter the pairs you’re interested in and Economatica will provide all the information you need to determine if the position is worth taking:

• Historical average of the current ratio;

• Number of standard deviations between the current ratio and the historical average;

• Beta of the pair; and

• Backtest to evaluate the success of the operation in the past.

Best of all the pair trading module lets you scan tens of thousands of pairs and find those that meet the specific conditions you set.

We used this option in the example below to find all possible pairs of the top 200 ETFs by the dollar value of the 30-day Average Daily Trading Volume.

Out of the 40,0000 pairs analyzed in a few moments, our pair trading module identified 5 possible pairs whose current ratio is more than 3 standard deviations from the mean.

In addition, only highly correlated pairs (70% or greater) with volatility under 50% were considered.

Economatica simplifies the process of identifying long/short opportunities. Ask us for a trial and try it out for free.

In this edition of Value Reports we examined the IPO market in the 1st half...

In this edition of Value Reports, we explore the Top 25 foreign stocks ranked by...

Using the Economatica system we calculated the EV/EBITDA (TTM) multiple for key sectors in the...