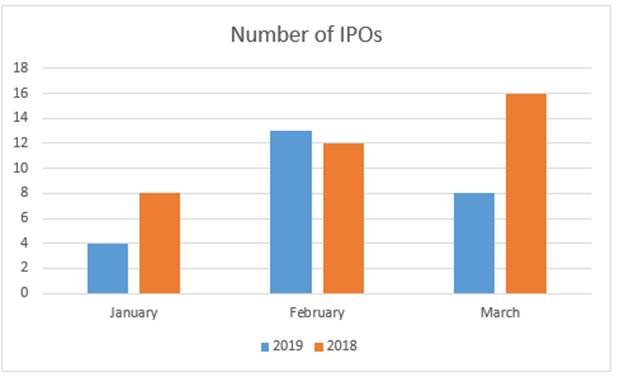

In this edition of Value Reports we examined the IPO market in the 1st quarter of 2019 and the data shows it has slowed down compared to the same period in 2018.

Using the Economatica system to filter through our comprehensive US financial data sets we discovered there were 25 IPOs in the 1st quarter of 2019.

Here are a few general observations about this group before diving into the details of the top and bottom performing new stocks for the first three months of 2019:

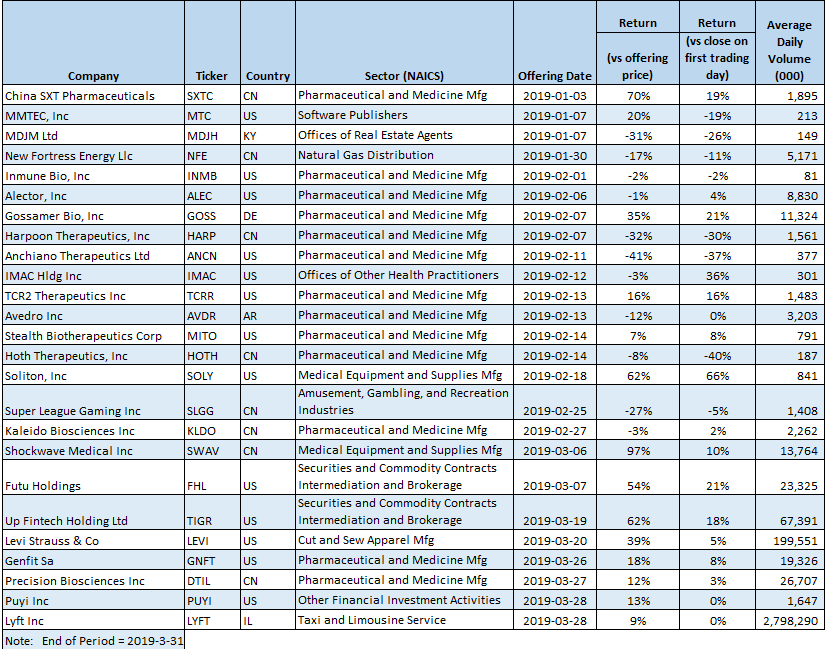

The following table is a list of IPOs for the first quarter of 2019 sorted by the first day of trading, with their respective returns and average daily trading volume for the quarter

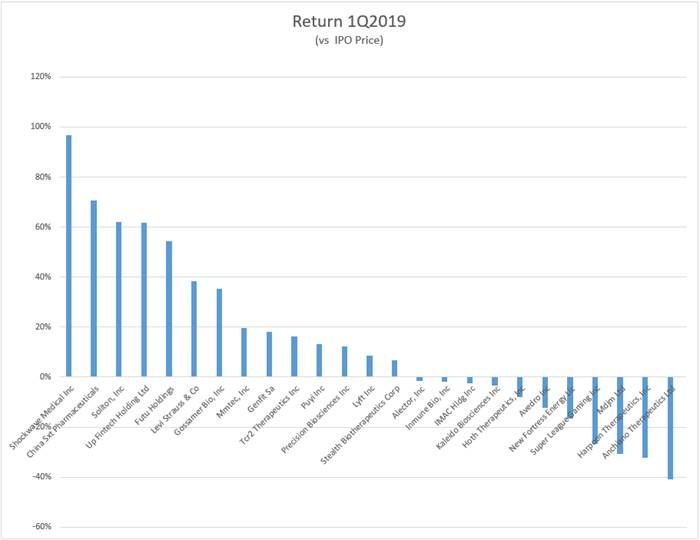

The chart below ranks the IPOs by quarter-end Returns compared to their IPO price, from best to worst performers. There were 14 companies in positive territory through the end of the quarter, while 11 were trading below their IPO price.

The stocks posting the highest returns (versus the offering price) are Shockwave Medical (up 97%), China SXT Pharmaceuticals (up 70%), and Soliton Inc and Up Fintech Holding (both up 62%).

The bottom 3 stocks are Anchiano Therapeutics (down -41%), Harpoon Therapeutics (down -32%), and MDJM Ltd (down -31%).

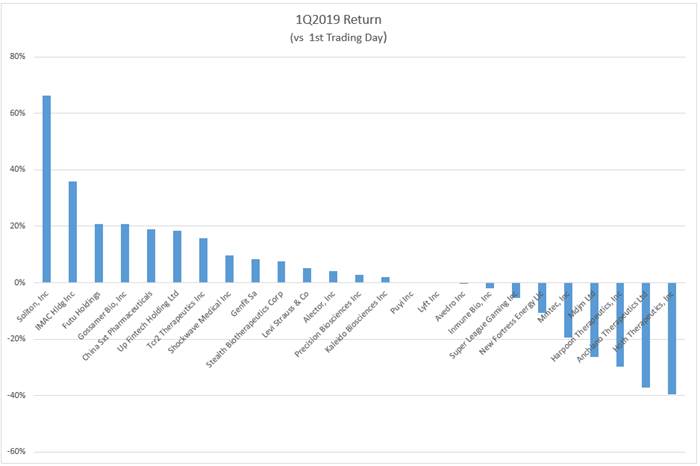

The chart below ranks the IPOs by quarter-end Returns compared to the close on the first trading day, from best to worst performers.

The best performing stock from opening day to the end of the quarter was Soliton Inc, which returned 66%, and the worst performing stock was Hoth Therapeutics which returned -40%.

In Q1 2019, we had 25 IPOs compared to 36 new issues in the same period for 2018. The highest number of IPOs was in the month of February, with 13 new stocks making their debut.

The Economatica system offers a range of sophisticated analytic tools and financial data on an easy to use online research platform that empowers asset managers, analysts, and other investment professionals to help you identify and examine potential opportunities. Ask us for a free trial today and learn how to make your own observations.

In this edition of Value Reports we examined the IPO market in the 1st half...

In this edition of Value Reports, we explore the Top 25 foreign stocks ranked by...

Using the Economatica system we calculated the EV/EBITDA (TTM) multiple for key sectors in the...