In this edition of Value Reports we examined the IPO market in the 1st quarter of 2018 and the data clearly points to increasing momentum.

22 companies (61.1%) were listed on NASDAQ while only 14 new issues (38.9%) were listed on the NYSE

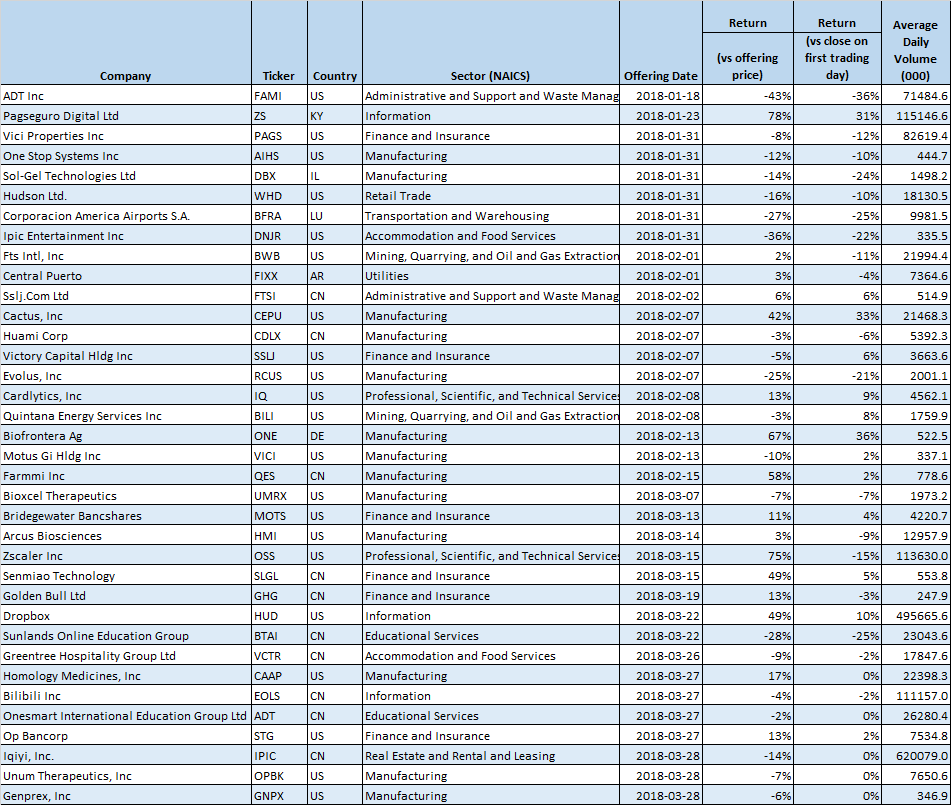

The following table is a list of IPOs Price for the first quarter of 2018 sorted by the first day of trading.

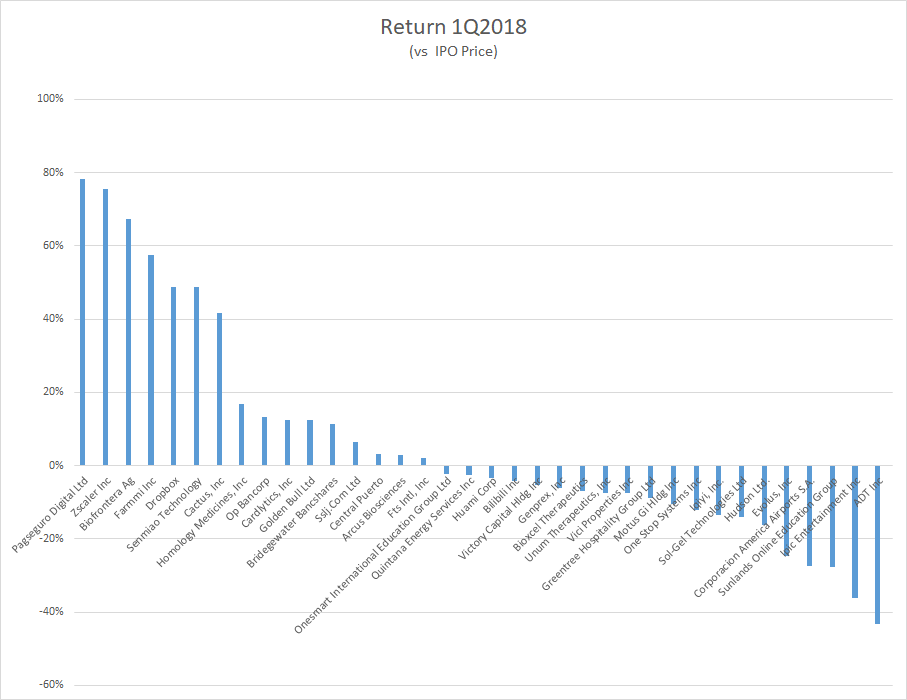

The chart below ranks the IPOs by quarter-end Returns compared to their IPO price, from best to worst performers. Sixteen companies are in positive territory, while 20 are trading below their IPO price.

Among the top 6 stocks launched in 2018 with the highest returns (versus the offering price) 4 are foreign companies and two are from the US. These are Pagseguro Digital (up 78%), Zscaler (up 75%), Biofrontera Ag (up 67%%), Farmmi (up 58%), and Dropbox and Seminao technology (both up 49%).

Among the bottom 6 stocks listed in the first quarter of 2018 with the lowest returns (versus the offering price) 4 are from the US and two are from abroad. These are ADT, Inc. (down -43%), Ipic Entertainment (down -36%), Sunlands Online Education (down -28%), Corporacion America Airports SA (down -27%), and Hudson Ltd. (down -16%).

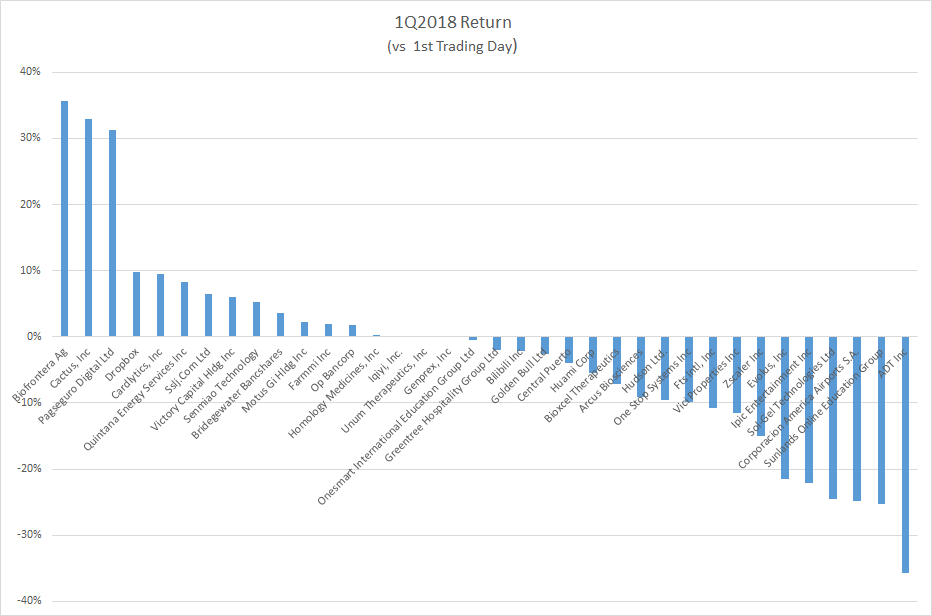

The chart below ranks the IPOs by quarter-end Returns compared to the close on the first trading day, from best to worst performers.

The best performing stock on its opening day was Biofrontera Ag from Germany, which returned 36% on February 13th, and the worst performing stock on its opening day was ADT, Inc., which was down -36% on January 18th.

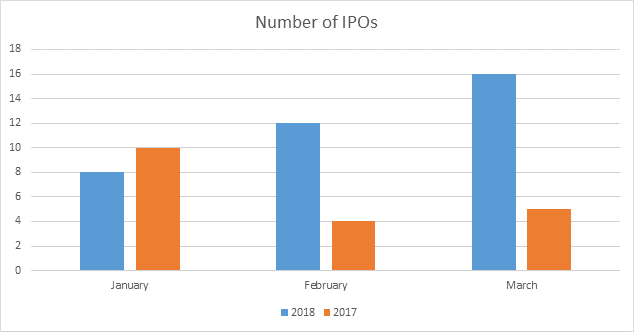

In 2018, we had 36 IPOs compared to 19 new issues in the same period for 2017. The highest number of IPOs was in the month of March, with 16 new stocks making their debut, more than triple the number of IPOs for the same month last year.

The Economatica system offers a range of sophisticated analytic tools and financial data on an easy to use online research platform that empowers asset managers, analysts, and other investment professionals to help you identify and examine potential opportunities. Ask us for a free trial today and learn how to make your own observations.

In this edition of Value Reports we examined the IPO market in the 1st half...

In this edition of Value Reports, we explore the Top 25 foreign stocks ranked by...

Using the Economatica system we calculated the EV/EBITDA (TTM) multiple for key sectors in the...