Using the Economatica system, we identified 1780 companies out of 3,500 companies listed on major US exchanges (excluding foreign companies and ADRs) that have reported earnings for the preceding quarter. Let’s now examine the 1st quarter Earnings Per Share (EPS) numbers reported on the participating companies’ financial statements and compare them to the same quarter a year ago.

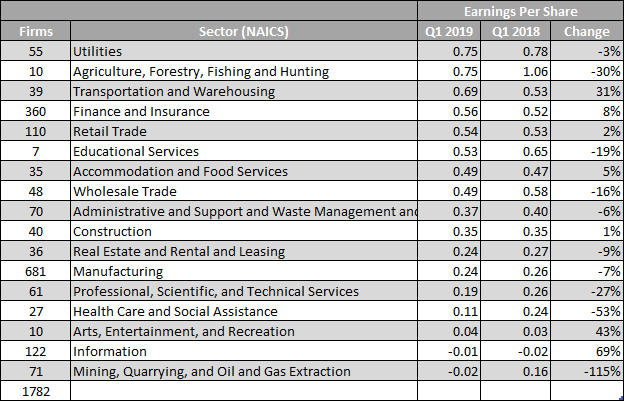

Now, although this figure represents only about 50% of the total universe of US companies, the market capitalization amounts to over 84% of the total universe. These companies also represent 17 key sectors of the market. The table below ranks Q1 2019 EPS from highest to lowest, compares it to the sector’s EPS from a year ago, and then we calculated the percent change for this period.

Two sectors came in tied with the highest EPS for Q1 2019, Utilities ($0.75) which also ranked highest for the same period last year, and Agriculture, Forestry, Fishing and Hunting ($0.75). TheTransportation and Warehousing sector, with 39 companies participating, ranks second with EPS of $0.69, up 31% from last year. Finance and Insurance (360 companies) takes third place in the current ranking with EPS of $0.56, up 8% from Q1 2018.

There were only two sectors with negative EPS in the sample for Q1 2019: Information (122 companies) with EPS of minus $0.01, and Mining, Quarrying and Oil and Gas Extraction (71 companies), which dropped from $0.16 in Q1 2018 to minus $0.02 in Q1 2019.

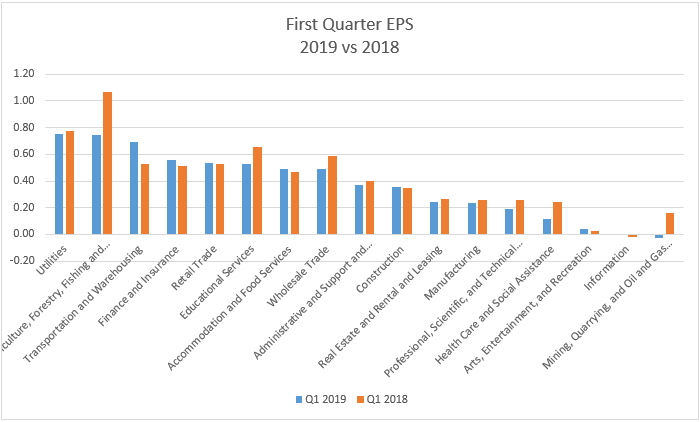

The following bar chart reiterates the observations described above.

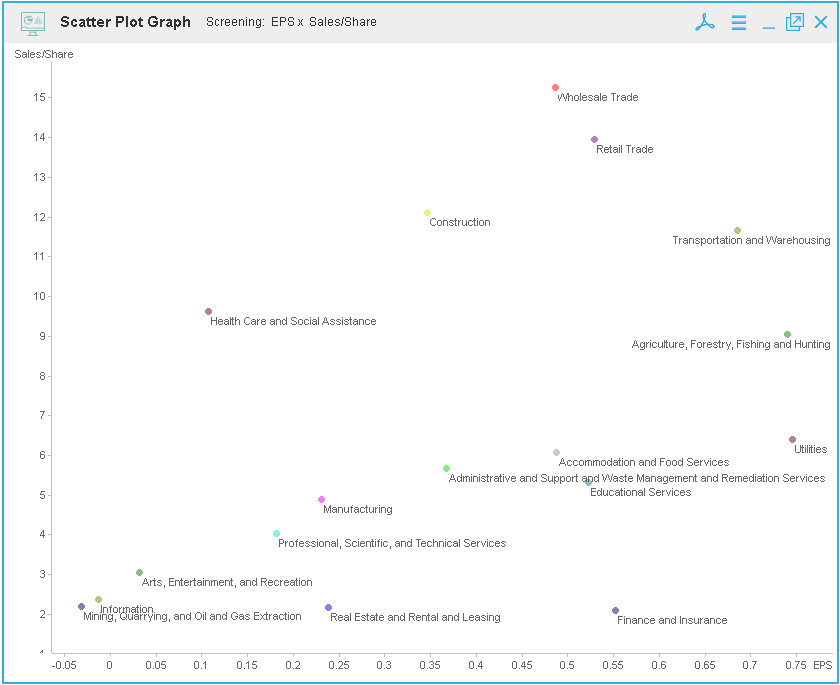

When you consider that revenues and EPS impact share prices it’s equally important to examine correlations between these two valuations. We used the Economatica system to highlight this correlation with the following scatter plot chart.

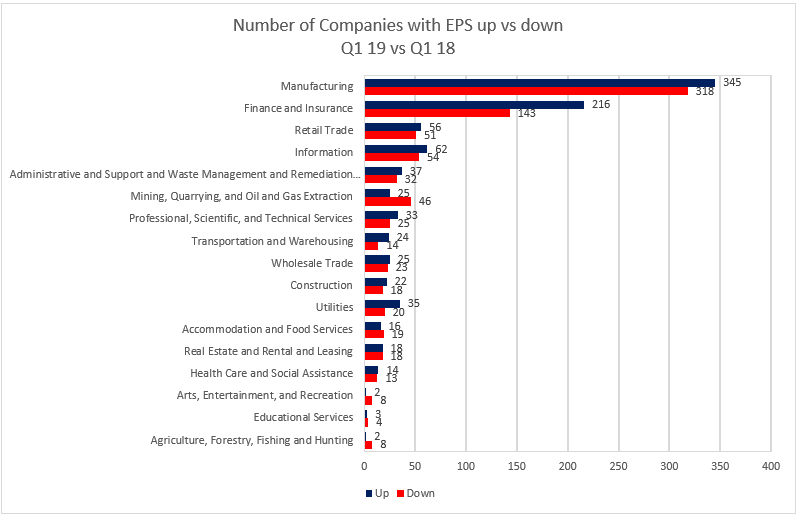

935 companies (53%) in our examination of Q1 2019 earnings reported higher EPS for this quarter than a year ago. In contrast, only 814 companies (47%) reported lower EPS for the same period. This is how the numbers break down among the 17 key sectors and participating companies sampled:

The sectors with the most companies reporting higher EPS for this past quarter compared to Q1 2018 are Utilities (35 versus 20), Transportation and Warehousing (24 versus 14), and Finance and Insurance (216 versus 143).

Economatica is an online investment research platform designed to facilitate deep fundamental and quantitative analysis. Asset managers, analysts, and other investment professionals have used Economatica for more than 30 years to research securities, identify opportunities, and make better investment decisions. To learn more please contact us.

In this edition of Value Reports we examined the IPO market in the 1st half...

In this edition of Value Reports, we explore the Top 25 foreign stocks ranked by...

Using the Economatica system we calculated the EV/EBITDA (TTM) multiple for key sectors in the...