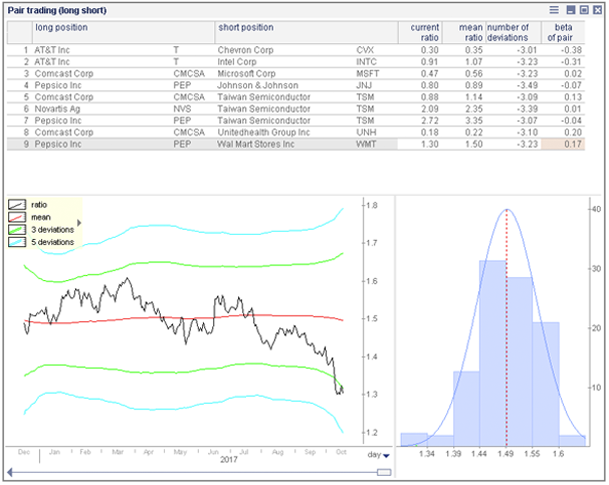

Identify the 9 current pairs whose ratio is more than 3 standard deviations from the mean, when considering the 40 largest public companies.

Pairs trading stategy: The Economatica system has a spectacular tool for identifying, analysing, and backtesting pair trades (long/short).

Simply enter the pairs you’re interested in and the system will provide all the information you need:

• Historical average of the current ratio;

• Number of standard deviations between the current ratio and

the historical average;

• Beta of the pair;

• Backtest to evaluate the success of the operation in the past.

Best of all the Pair Trading tool lets you scan tens of thousands of pairs and find those that meet the specific conditions you set.

In the example below the system examined all possible pairs of the 40 largest public companies (and analyzed 1,600 possible pairs), identifying 9 pairs whose current ratio is more than 3 standard deviations from the mean.

In this edition of Value Reports we examined the IPO market in the 1st half...

In this edition of Value Reports, we explore the Top 25 foreign stocks ranked by...

Using the Economatica system we calculated the EV/EBITDA (TTM) multiple for key sectors in the...