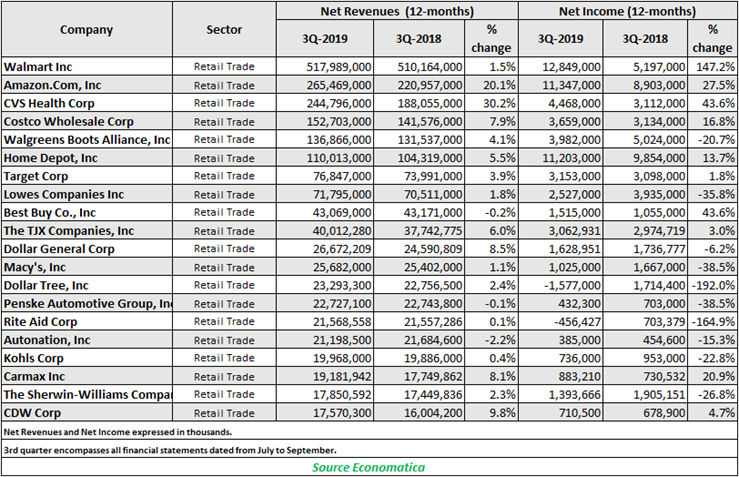

Comparing year-over-year results, we find that 17 out of the 20 retailers experienced growth in revenues when comparing 3Q2019 with 3Q2018 on a 12-month basis. CVS Health Corp is the group’s leader on top line growth as it increased revenues by 30.17% over the last 12 months. Its net income for the 12-month period increased 44%. Amazon, the online retailer, is in second place posting revenue growth of 20.15% in the 12-month period. It grew net income by 27% in the period.

The three companies that were unable to grow revenues were Autonation, Best Buy, and Penske Automotive Group, posting a decline in revenues of -2.24%, -0.24%, and -0.07 respectively.

When examining the bottom line, we find that 10 out of the 20 experienced growth in net income when comparing 3Q2019 with 3Q2018. Walmart comes out on top with the highest growth on the bottom line with 147% year-over-year. It is followed by Best Buy and CVS Health Corp, which grew revenues by 44% each respectively.

Two companies stand out as the worst performers by net income growth: Dollar Tree and Rite Aid, whose revenues declined 192% and 165% respectively in the period.

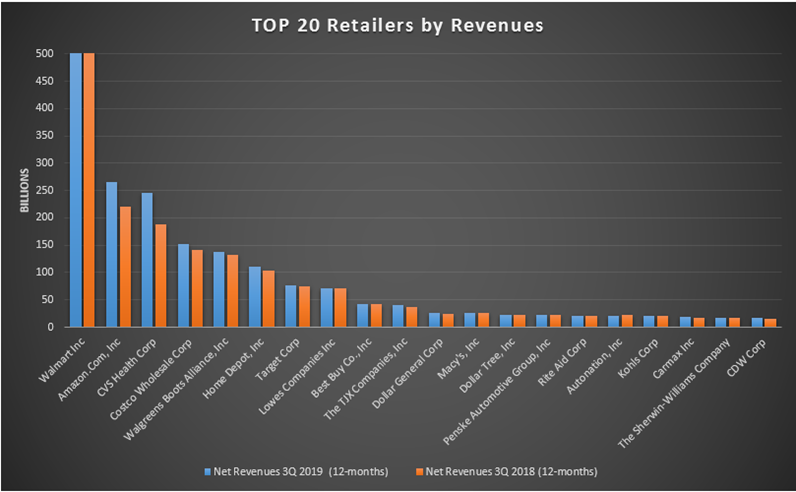

The chart below helps put into perspective how impressive Walmart’s revenues are relative to the rest of the retailers, even when compared to Amazon. Walmart’s revenues of 518B nearly doubles the 265B posted by Amazon in second place.

Economatica is an online investment research platform designed to facilitate deep fundamental and quantitative analysis. Asset managers, analysts, and other investment professionals have used Economatica for more than 30 years to research securities, identify opportunities, and make better investment decisions. To learn more please contact us.

In this edition of Value Reports we examined the IPO market in the 1st half...

In this edition of Value Reports, we explore the Top 25 foreign stocks ranked by...

Using the Economatica system we calculated the EV/EBITDA (TTM) multiple for key sectors in the...