Economatica has a powerful yet easy to use module for identifying, analyzing, and back-testing pair trades (long/short).

We used the Economatica system to find all possible pairs of the top 200 REITs by the dollar value of the 30-day Average Daily Trading Volume. Therefore a total of 40,000 pairs of REITs were analyzed (200 x 200).

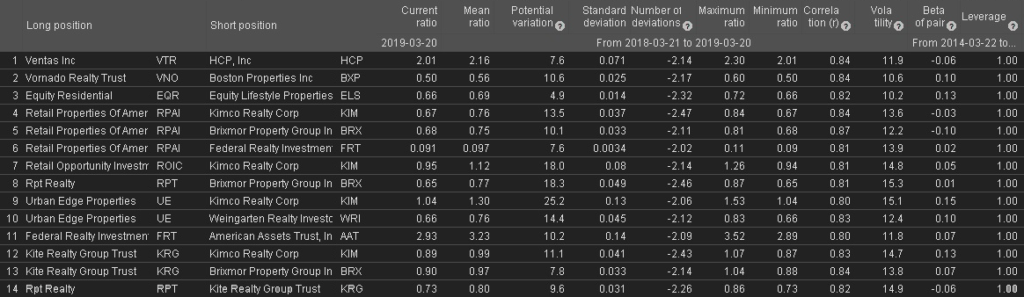

Out of the universe of 40,000 pairs analyzed in a few moments, the Economatica system identified 14 pairs whose current ratio sits currently more than 2 and less than 4 standard deviations from the mean as of 3/20/2019. In addition, in making this selection we asked that only highly correlated pairs (80% or greater) with volatility under 50% were considered.

The table below shows the 14 pairs meeting the criteria along with various analytical metrics for your review.

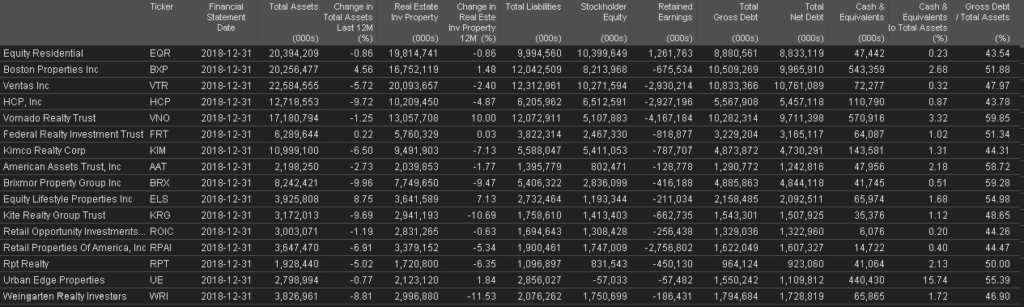

For additional insight into these REITs, we used the Economatica system to produce the following report with various fundamental metrics.

Economatica is an online investment research platform designed to facilitate deep fundamental and quantitative analysis. Asset managers, analysts, and other investment professionals have used Economatica for more than 30 years to research securities, identify opportunities, and make better investment decisions. To learn more please contact us.

In this edition of Value Reports we examined the IPO market in the 1st half...

In this edition of Value Reports, we explore the Top 25 foreign stocks ranked by...

Using the Economatica system we calculated the EV/EBITDA (TTM) multiple for key sectors in the...