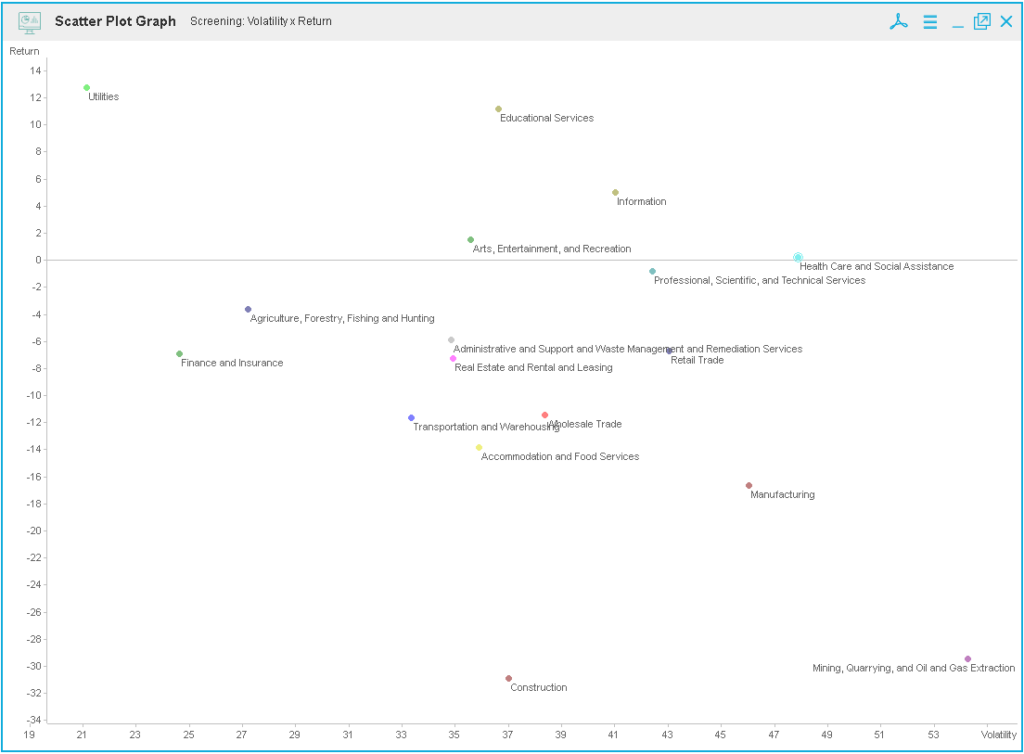

As a measure of risk we employed the metric Annual Volatility, calculated using daily returns over the last 12 months. The median volatility and return is calculated for each sector.

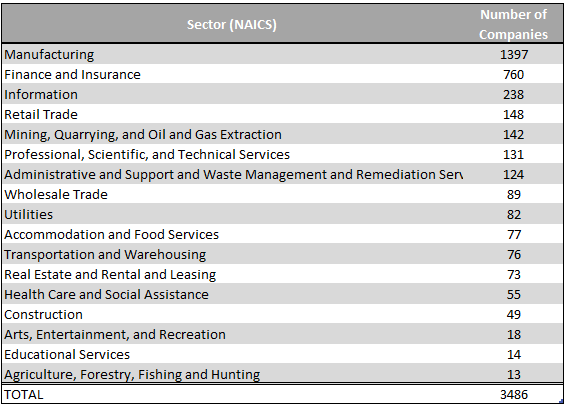

Using the Economatica system we profiled the shares of nearly 3,500 companies.

Only four sectors show a positive return over the last 12 months. These sectors are Utilities, Educational Services, Information, and Arts, Entertainment, and Recreation. Of all the sectors examined, the Utilities sector also had the lowest volatility in the period.

The sectors with the worst performance based on their last 12-month returns are Construction, Mining, Quarrying, and Oil And Gas Extraction, and Manufacturing. The sector with the highest volatility in the period is Mining, Quarrying, and Oil and Gas Extraction.

The table below provides the breakdown of the number of companies sampled by sector.

The Economatica system offers a range of sophisticated analytic tools and financial data on an easy to use online research platform that empowers asset managers, analysts, and other investment professionals who conduct fundamental and quantitative analysis. Ask us for a free 14-day trial today and learn how to make your own observations.

In this edition of Value Reports we examined the IPO market in the 1st half...

In this edition of Value Reports, we explore the Top 25 foreign stocks ranked by...

Using the Economatica system we calculated the EV/EBITDA (TTM) multiple for key sectors in the...