Using the Economatica system to filter through our comprehensive database of US exchange listed stocks, aggregating returns by sector to identify the industry with the highest year-to-date return.

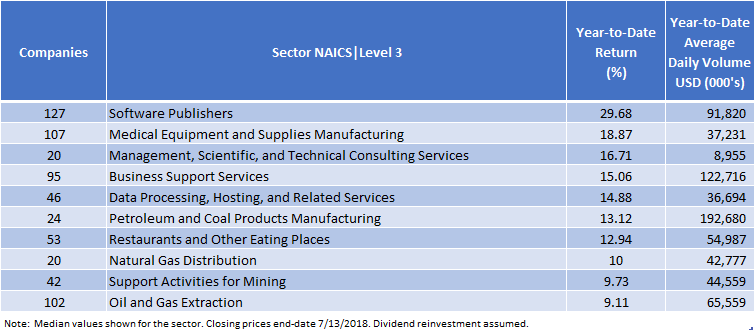

While the broader market indices posted modest year-to-date gains through 7/13/2018, with the S&P 500 up 4.78% and the Dow Jones Industrial Average just up 1.21% for the year, the Software Publishing sector has dominated the market so far this year, boasting a year-to-date return of 29.68%. The participating companies within the Medical Equipment and Supplies Manufacturing and Management, Scientific, and Technical Consulting Services sectors have second and third highest year-to-date returns (18.87% and 16.71%, respectively).

The table below shows the Top 10 performers by sector based on Year-to-Date Returns through 7/13/2018.

Since the Software Publishing sector had the highest year-to-date return we wanted to compare its performance with the broader market indices. To do this we created an index consisting of the 127 participating companies in this sector and plotted this index against the S&P 500 and Dow Jones indices.

Using the Economatica system to build indices like the one depicted in the chart above clearly demonstrates this sector’s impressive year-to-date performance.

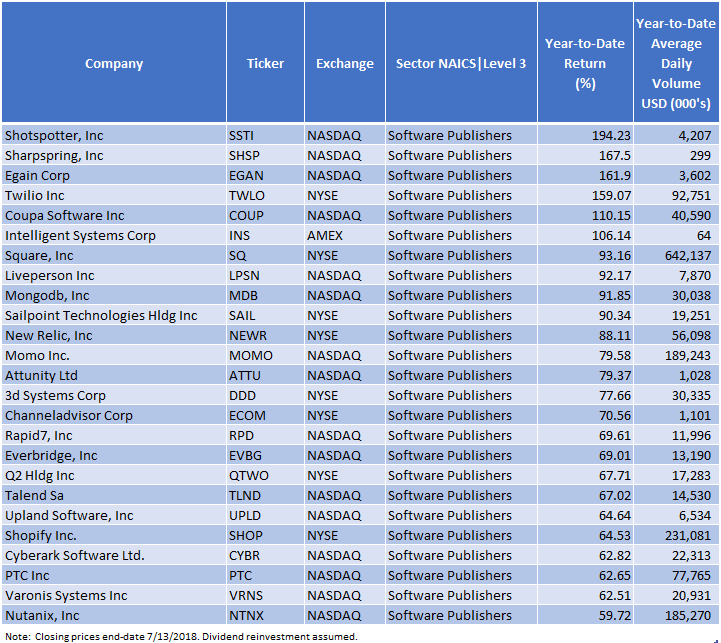

Ranking the 25 Best Performing Software Publishers by Year to Date Return, highest to lowest, we identified a clear winner: Shotspotter, Inc., the global leader in gunfire detection and location technology, has posted an impressive 194.23% YTD return. Taking second and third place in this ranking are Sharpspring, Inc. and Egain Corp, which posted year-to-date returns of 167.5% and 161.9%, respectively.

The Economatica system offers a range of sophisticated analytic tools and financial data on an easy to use online research platform that empowers asset managers, analysts, and other investment professionals to help you identify and examine potential opportunities. Ask us for a free trial today and learn how to make your own observations.

In this edition of Value Reports we examined the IPO market in the 1st half...

In this edition of Value Reports, we explore the Top 25 foreign stocks ranked by...

Using the Economatica system we calculated the EV/EBITDA (TTM) multiple for key sectors in the...