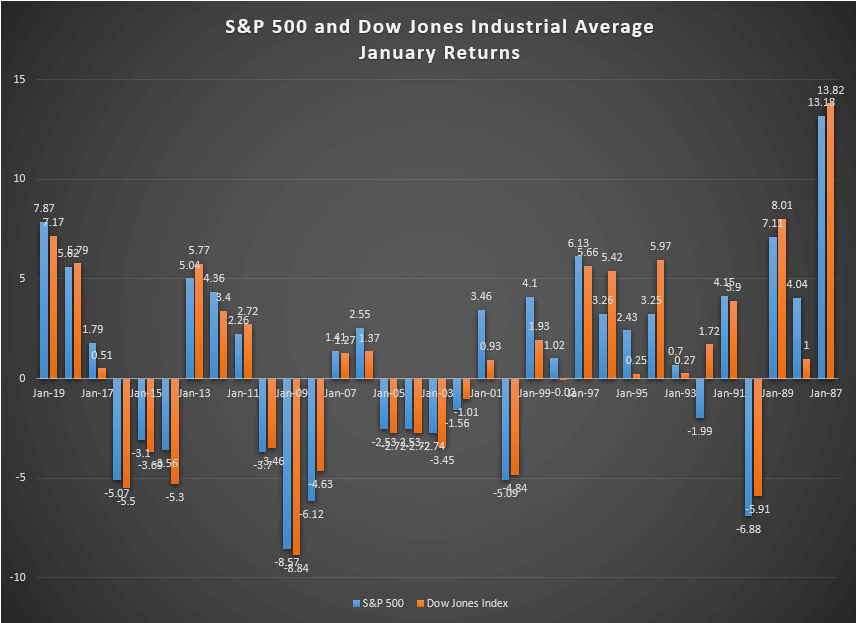

Economatica examined the January returns for the S&P 500 and the Dow Jones Industrial Average (Dow) over the past 32 years and made the following observations from the chart below:

The Dow posted a strong return of 7.17% in the month of January, now the best January return for the index since 1989. The S&P 500 returned 7.87% this January and is the highest January return since 1987.

The highest return for the Dow in the period examined was in January 1987 with 13.82% while the lowest for the index was in January 2009 with a – 8.84% return.

The highest return for the S&P 500 was also in January 1987 when the index returned 13.18%; its lowest January return was also in 2009, with a – 8.57% return.

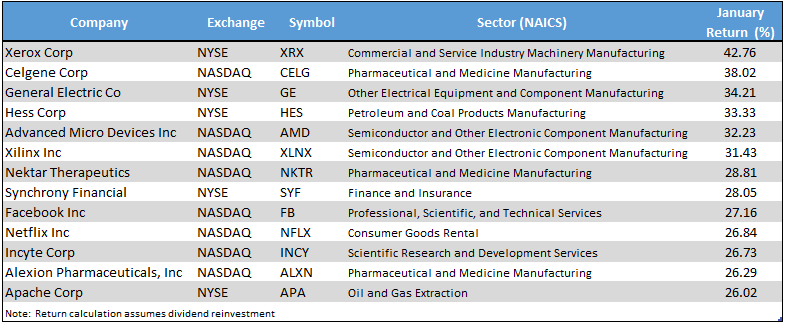

There were 13 stocks in the S&P 500 that exceeded 25% returns this January. Xerox Corp had the highest return with a whopping 42.76%, followed by Celgene Corp and General Electric with returns of 38.02% and 34.21% respectively.

Economatica helps asset managers, analysts, and other investment professionals conduct fundamental and quantitative analysis with a flexible, easy to use online research platform. Ask us for a free trial today and see how the Economatica system will contribute to making more precise investment decisions.

In this edition of Value Reports we examined the IPO market in the 1st half...

In this edition of Value Reports, we explore the Top 25 foreign stocks ranked by...

Using the Economatica system we calculated the EV/EBITDA (TTM) multiple for key sectors in the...