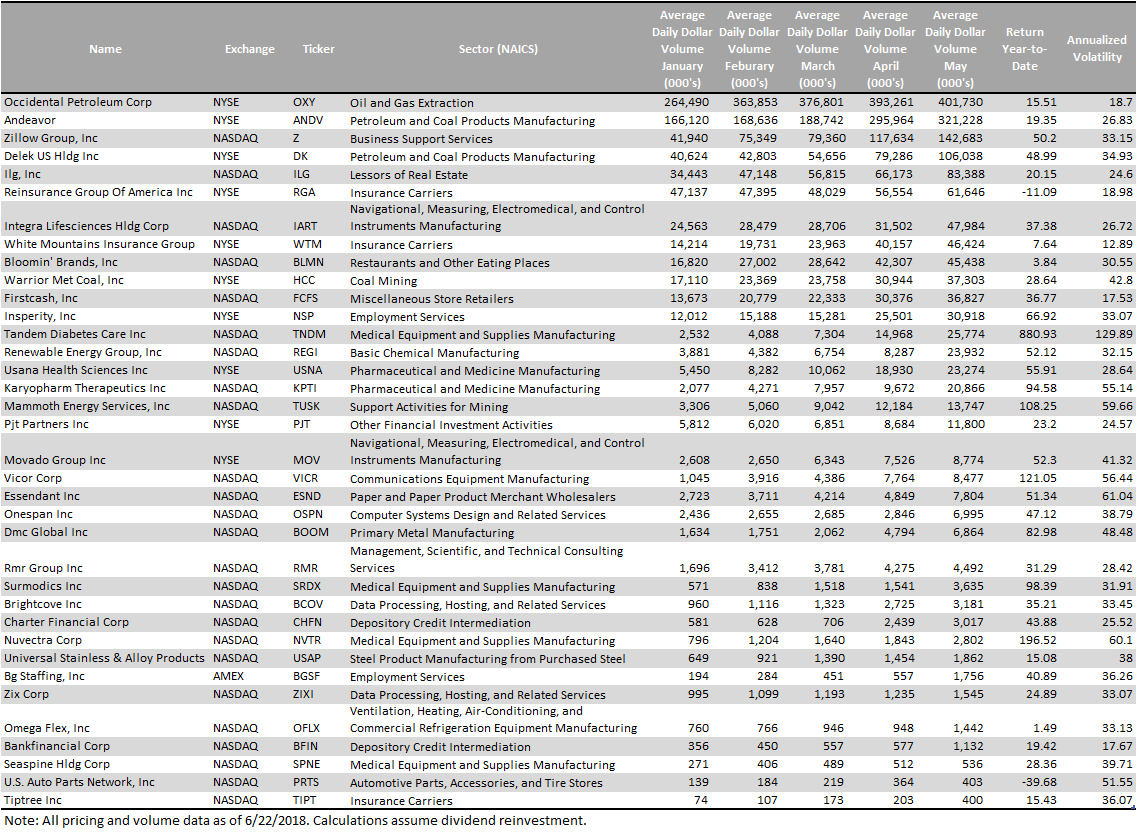

Economatica canvassed 3,600 stocks traded in US Exchanges, and identified only

37 stocks whose average daily dollar volume has increased each single month from January to May this year.

We rank this list by May 2018 average daily dollar volume, and topping the list we have Occidental Petroleum (NYSE: OXY), Andeavor (NYSE: ANDV), and Zillow Group (NYSE: Z). Occidental Petroleum increased its average daily dollar volume from 264.49 million in January to 401.73 million in May. Andeavor increased its average daily dollar volume from 166.12 million in January to 321.23 million in May. And Zillow Group increased its average daily dollar volume from 41.94 million in January to 142.68 in May. These increases represent gains of 52%, 93%, and 240% respectively in daily trading activity.

The top three best performers by year-to-date return are Tandem Diabetes Care (NASDAQ: TNDM), Nuvectra Corp (NASDAQ: NVTR), and Vicor Corp (NASDAQ: ESND) with 880.93%, 196.52% and 121.05% respectively. High annualized volatility was associated with these higher returns, coming in at 129.89%, 60.1%, and 56.44% respectively.

Economatica is an online investment research platform designed to facilitate deep fundamental and quantitative analysis. Asset managers, analysts, and other investment professionals have used Economatica for more than 30 years to research securities, identify opportunities, and make better investment decisions. To learn more please contact us.

In this edition of Value Reports we examined the IPO market in the 1st half...

In this edition of Value Reports, we explore the Top 25 foreign stocks ranked by...

Using the Economatica system we calculated the EV/EBITDA (TTM) multiple for key sectors in the...