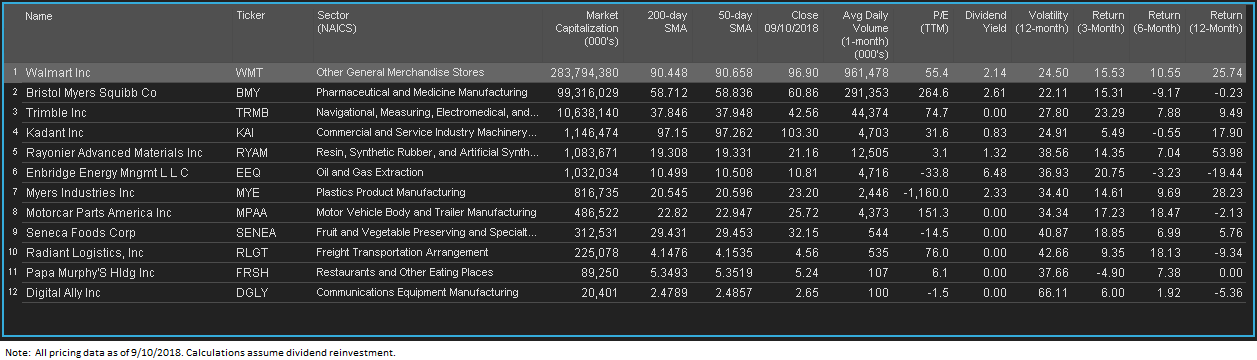

Economatica has powerful technical analysis tools. We used the Economatica system to highlight all stocks whose 50-day SMA crossed over their 200-day SMA. There were 12 stocks meeting this criteria, out of a universe of 3,600 stocks screened.

Walmart (WMT) and Brystol Myers (BMY) are the largest stocks by market capitalization making the list.

As a general rule, traders consider a bullish sign when the 50-day moving average crosses above the 200-day moving average.

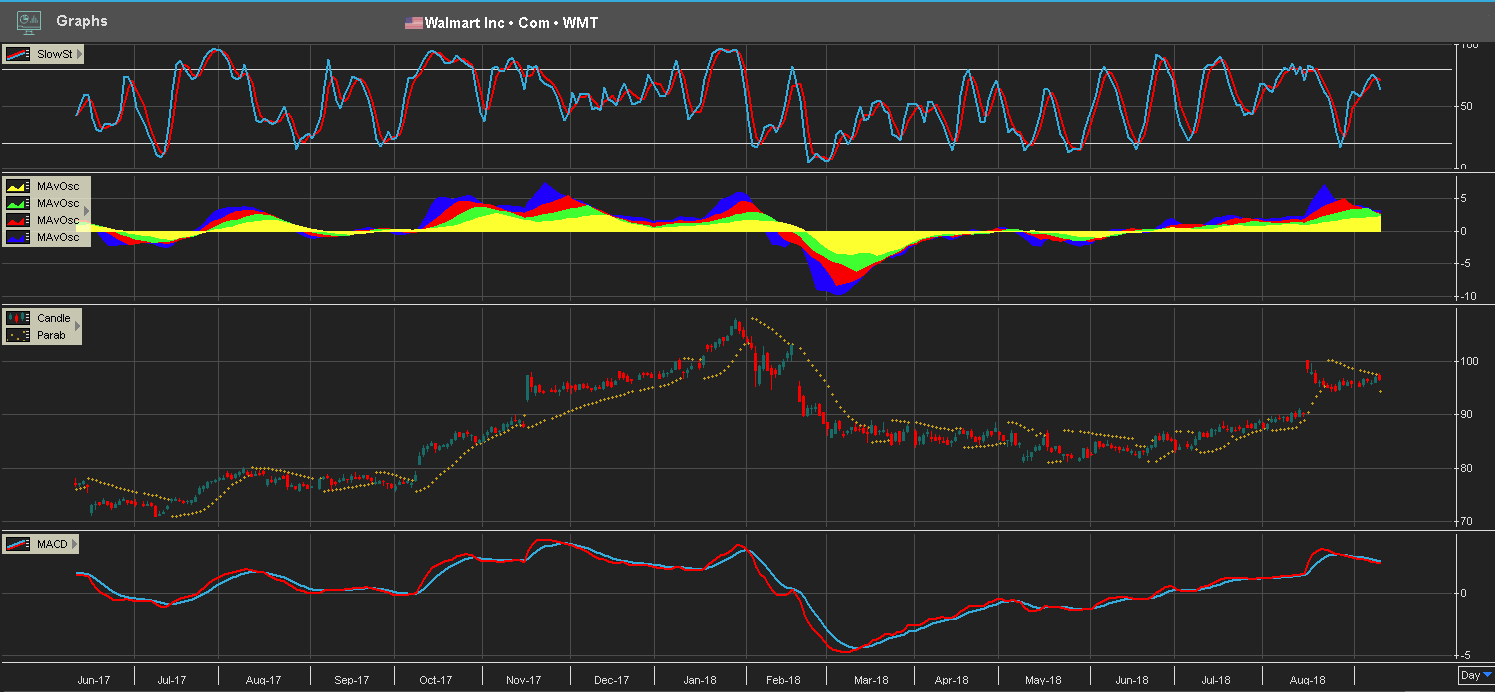

Using the Economatica system, we generated this chart for WMT with additional technical indicators:

Economatica is an online investment research platform designed to facilitate deep fundamental and quantitative analysis. Asset managers, analysts, and other investment professionals have used Economatica for more than 30 years to research securities, identify opportunities, and make better investment decisions. To learn more please contact us.

In this edition of Value Reports we examined the IPO market in the 1st half...

In this edition of Value Reports, we explore the Top 25 foreign stocks ranked by...

Using the Economatica system we calculated the EV/EBITDA (TTM) multiple for key sectors in the...