In investing, risk and return are highly correlated and increased potential returns on investments usually go hand-in-hand with increased risk.

To highlight the impact risk-return analysis on large cap equities we ranked the top 25 companies by market capitalization and, using the Economatica system, we calculated their 1-year risk / return profiles and generated a scatter plot chart to visualize the results. For the purpose of this analysis, as a measure of risk, we employed the volatility metric.

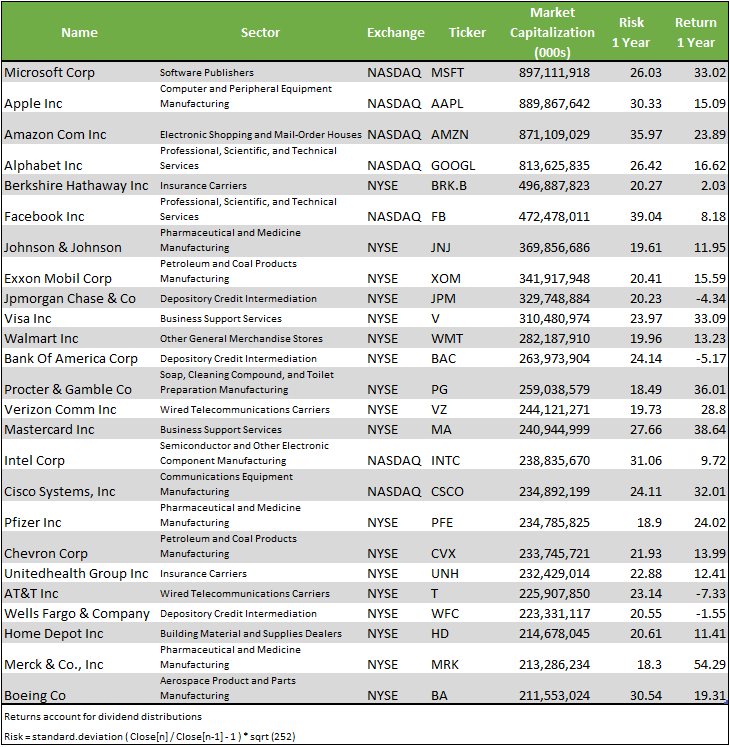

In the table below, the companies are ranked by market capitalization, from highest to lowest. 21 stocks have had positive 1-year returns, 4 have had negative 1-year returns, 7 companies are listed on NASDAQ, and the remaining 18 other companies are listed on the NYSE. In terms of risk, 8 companies’ risk profile is greater than 30, and topping the list by this metric is Facebook with a value of 39.04%.

The three companies with the highest 1-year returns are: Merck (54.29%), Mastercard (38.64), and Procter & Gamble (36.01%). The 1-year risk for these companies are 18.3%, 27.66%, and 18.49%, respectively.

The three companies with the lowest 1 year returns are: AT&T (-7.33%), Bank of America (-5.17%), and JP Morgan (-4.34%). And, the 1-year risk for these companies are 23.14%, 24.14%, and 20.23%, respectively.

The analysis of risk-return is perhaps best depicted in a scatter plot chart as you can easily see which companies pose the least amount of risk (and usually lower returns) and those with the greatest amount of risk (and usually higher returns).

For example, the two companies with the least amount of risk are Merck and Procter & Gamble, 18.3% and 18.49% respectively. In contrast, Facebook, Amazon, and Intel have the highest measure of risk: -39.04%, -35.97%, and -31.06%, respectively.

The Economatica system offers a range of sophisticated analytic tools and financial data on an easy to use online research platform that empowers asset managers, analysts, and other investment professionals to help you identify and examine potential opportunities. Ask us for a free trial today and learn how to make your own observations such as these.

In this edition of Value Reports we examined the IPO market in the 1st half...

In this edition of Value Reports, we explore the Top 25 foreign stocks ranked by...

Using the Economatica system we calculated the EV/EBITDA (TTM) multiple for key sectors in the...