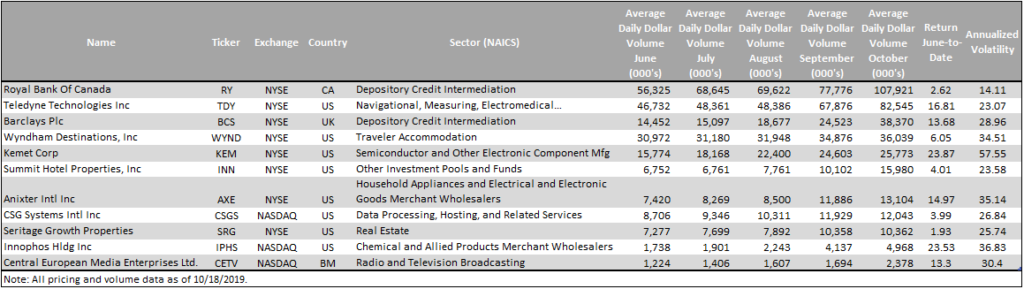

Economatica canvassed 4,400 stocks traded in US Exchanges, and identified only 11 stocks whose average daily dollar volume was greater than 1 million, has increased this metric each single month from June to October this year, and whose return is positive in this period.

We rank this list by average daily dollar volume, and topping the list we have Royal Bank of Canada (NYSE: RY), Teledyne Technologies (NYSE: TDY), and Barclays (NYSE: BCS). The Royal Bank of Canada increased its average daily dollar volume from 56.33 million in June to 107.92 million in October. Teledyne Technologies increased its average daily dollar volume from 46.73 million in June to 82.55 million in October. And Barclays increased its average daily dollar volume from 14.45 million in June to 38.37 million in October. These increases represent gains of 92%, 77%, and 165% respectively in daily trading activity.

The top three best performers by return in the period are Kemet Corp (NYSE: KEM), Innophos Hldg (NASDAQ: IPHS), and Teledyne Technologies (NYSE: TDY) with 23.87%, 23.53% and 16.81% respectively. Higher volatility (annualized) was associated with these higher returns, coming in at 57.55%, 36.83%, and 23.07% respectively.

The Economatica system offers a range of sophisticated analytic tools and financial data on an easy to use online research platform that empowers asset managers, analysts, and other investment professionals to help you identify and examine potential opportunities. Ask us for a free trial today and learn how to make your own observations.

In this edition of Value Reports we examined the IPO market in the 1st half...

In this edition of Value Reports, we explore the Top 25 foreign stocks ranked by...

Using the Economatica system we calculated the EV/EBITDA (TTM) multiple for key sectors in the...