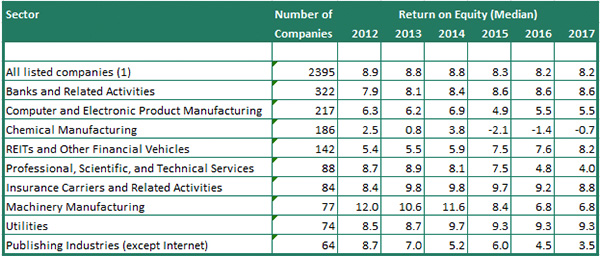

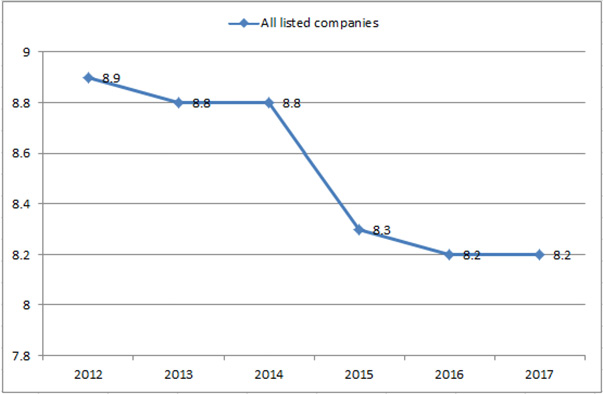

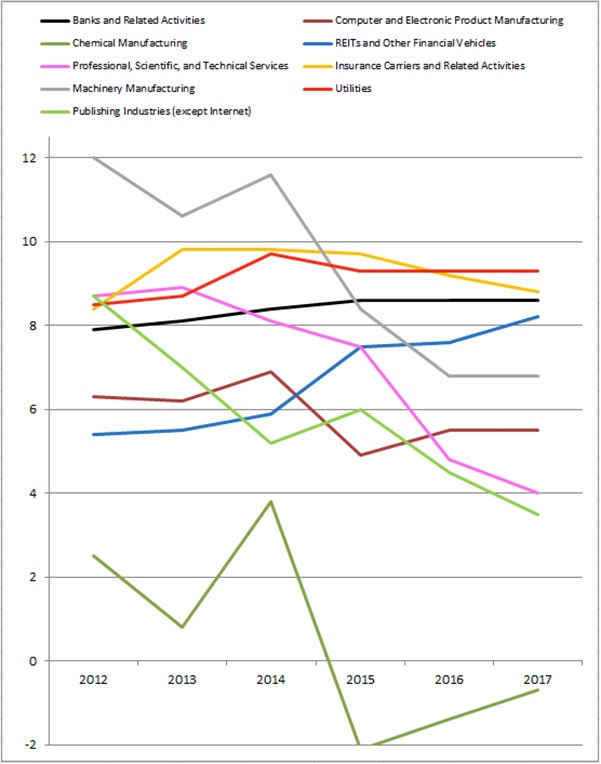

This week’s Value Report shows that although the median of all listed companies shows a modest drop in ROE, some sectors have suffered more significant declines from 2012 to now. It is also possible to observe that:

• Among the broader sectors of the market, 3 are in marked decline: Machinery Manufacturing, Publishing Industries (except Internet) and Professional, Scientific and Technical Services;

• Considering these same sectors, only REITs and Other Financial Vehicles show a systematic increase in the median ROE;

• The Chemical Manufacturing industry includes a large number of Biotech companies that are still pre-operational, resulting in a negative ROE for the last 3 years.

• Only US companies (not ADRs) for which data were available on all dates analyzed were considered;

• Median ROE is calculated as the net profit for the year divided by the average of the shareholders’ equity at the beginning and at the end of the year, times 100;

• For 2017, the net income for the 12 months prior to the last financial statement published by the company (06/30/2017 or 09/30/ 2017) was taken and the average of the shareholders’ equity values at the beginning and at the end of this period.

In this edition of Value Reports we examined the IPO market in the 1st half...

In this edition of Value Reports, we explore the Top 25 foreign stocks ranked by...

Using the Economatica system we calculated the EV/EBITDA (TTM) multiple for key sectors in the...